Originally posted December 2015

I have been having an internal debate about what I am missing in the economics of leasehold improvements. I wonder if there is some magic in leasehold improvements I have failed to grasp that others have known for a long time.

- Is there some unaccounted for value in an office building from existing leasehold improvements?

- Why does the appraisal community not specifically address the weighted average remaining economic life of the leasehold improvements in place?

- Does the standard discounted cash flow analysis approach effectively reflect the impact of aging leasehold improvements?

I hope the following recitation of this struggle of mine will inspire those in the know to share this magic.

Definition

I consider leasehold improvements to be all the stuff that a tenant has added to its leased premises above and beyond: the floor covering; the t-bar ceiling tiles to be installed; the HVAC to be distributed; the electrical to be distributed; and, the demising walls (which are typically primed and ready for paint): much like the base building illustrated in the before picture below.

Before:

Leasehold improvements include the demising walls to get reception areas, boardrooms, meeting rooms, offices, storage areas, printer areas, server rooms, kitchens, etc. There may be upgrades to HVAC for boardrooms and server rooms. For the purposes of this discussion I do not consider items like furniture that are portable to be leasehold improvements.

After:

Check out the leasehold improvements Google has installed in its Chicago office.

Pro-forma cost item

We find that leasehold improvements for brand new premises have a ballpark cost someplace between $50 per square foot and $100 per square foot, with the difference mostly a function of the proportion of enclosed offices as well as the quality of the finishes.

What is notable is that this is the second largest cost in a typical pro-forma after the hard costs of constructing the buildings. It is more than land costs per square foot buildable, it is more than soft costs (consultants and development charges), and it is more than site works. It is a significant investment, yet an investment that has the shortest economic life.

Please note that a pro-forma may not include the entirety of the cost of the leasehold improvements per square foot, just the quantum we will provide as it relates to the face rent being achieved. The tenant will need to contribute to the cost of the leaseholds as well. Once completed, our contribution and that of the tenant combined is $50–$100 per square foot.

Leasehold improvements are necessary for a particular tenant, and paid in part by the tenant, but the NOI will not incorporate tenant spending on improvements. This is that store of unaccounted for value that I wonder about.

Lifecycle

The consensus view is that the economic life of the leaseholds installed for new space is 10-15 years. Some elements of the leaseholds installed are expensive to do and used by most firms – server rooms, kitchens, reception area, UPS, back-up generator, raised floor, Leibert supplemental cooling – and as a result may be of use to the next tenant who occupies the space. Other elements like the floor covering and the wall surfaces are subject to wear and tear that can be mitigated by a refurbishment program. As an example, it seems that carpet tile is installed to allow for refurbishment of high traffic areas without having to replace the carpet in its entirety.

Most tenants on tour will look at the existing space to try to figure out whether the floor configuration will suit their various groups and whether there are enough offices provided. The answer is usually no. And so those demising walls that were costly to install, will be costly to remove, and will be costly to install someplace else. If it is possible to recycle some of those leaseholds improvements, the deal becomes less costly. Those leasehold improvements that could be recycled are potentially a store of value.

The other element that is noted is colours and styles – carpet colours, wall covering colours and textures, door and sidelight treatments, etc. These stylistic elements can date space, and it is pretty infrequent that stylistic choices are still in favour 10-15 years after installation. For those of us who have been doing this for a while, colour schemes can be the best indication of just how old the existing leaseholds are. It is noteworthy that the “staging” exercise common to houses for sale is not a standard business practice for recycling office suites.

It is a little odd that building assessments can produce a schedule for capital expenditures to repair and replace building systems and do not comment on the remaining economic life of the leasehold improvements.

To recycle or not to recycle

While the economic life of the leasehold improvements is 10-15 years, the lease is usually less than 15 years. As a result, there could be remaining economic life in the leasehold improvements, as noted in the above example, particularly if the departing tenant installed some expensive stuff that every tenant values.

Given this scenario, wouldn’t there be a temptation to leave the old leaseholds in place to see if there would be a taker for them with little modification required? Perhaps this way the new lease transaction spends less on tenant improvements than budgeted, and some broker tenant rep would be a hero.

The challenge is that generally, prospective tenants struggle to imagine anything other than what is presented to them as they walk through the vacancy. The initial tour of options available to them could easily involve 10-20 suites and they want to get to a short list of 3-5 options and getting from twenty options to three options usually does not involve a lot of analysis.

From the landlord perspective, the goal of the initial tour is to get on the short list. Making the short list means not getting eliminated, and with 10-20 options available, the reasons for elimination can be trivial or easily fixed beforehand. Since broker tenant reps just want to get to a short list too, they will not work to ensure every option is examined in length to provide feedback to the landlord as to how to improve in order to help them get to the short list.

For the tenant on tour, older leasehold improvements with worn-out floor covering and a layout not of interest gives them plenty of reasons to eliminate that suite. It does not matter that the landlord is “waiting to find out what someone wants to retain because we are all set to replace the rest of it”, the potential tenant has achieved its goal in the initial tour of eliminating options to get to a short list.

The dilemma then is, does the landlord spend money to demolish the existing leaseholds and start over with brand new leaseholds in an attempt to appeal to all potential new tenants on tour; or, does the landlord retain the existing leaseholds with the hope that some to most of the existing leaseholds will appeal to the next tenant and offer a less expensive deal for notionally the same leasehold improvements. Tough choice.

The choice is certainly submarket dependent. For the Kanata submarket in Ottawa, what really appealed to tenants post high tech wreck was “plug and play” space, as this provided the next tenant space that they could function in at a low rental rate with little delay to occupancy. Ten years later, that “plug and play” space is now pretty much at the end of its economic life.

The choice is also affected by the shift from individual office/cubicle to collaborative workspace. More tenants are looking to make their work space more collaborative, so may shy away from vacant space with existing leaseholds that are not as collaborative as the tenant intends, particularly in contrast with wide open base building space options for the short list.

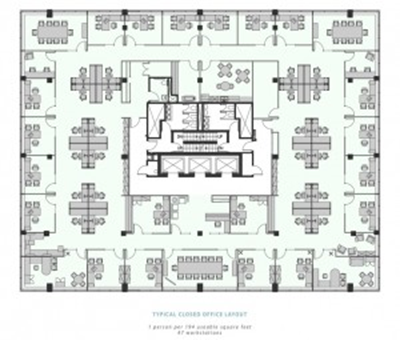

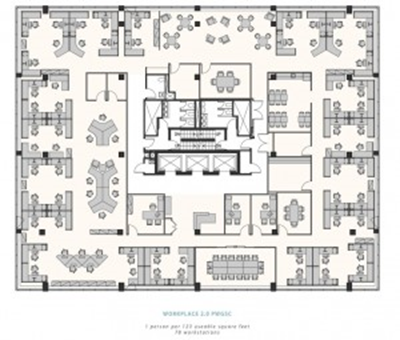

Locally, Metcalfe Realty has done sample floor layouts for both enclosed office and the PWGSC Workplace 2.0 collaborative space for its renovation of 123 Slater Street.

If you are looking to place the 78 workstations as illustrated in the collaborative space plan, there is not much point in seeing the existing 47 workstation option, is there?

Restitution clause

Oftentimes the lease has included a clause that requires the tenant to return the premises in the state they were found before the installation of the leasehold improvements, i.e. back to base building. This could require a tenant to demolish the leasehold improvements they installed such that the landlord avoids the costs associated to getting the suite back to base building for the next tenant.

This clause is contentious. The exiting tenant would have been required to get landlord approval for the leasehold improvements it installed initially, and may claim that seeing as the landlord approved them there is no need then for them to be removed. As well, the landlord may want to pick and choose what gets restituted, as there may be some leasehold improvements of value to most other possible tenants for the suite to be vacated. By this I mean the landlord will want to keep the good stuff and have the tenant remove the problematic stuff that is expensive to remove.

The landlord concern for restitution is often the leasehold improvements installed for a tenant has made the tenant sticky, by which I mean the probability of renewal is higher as the tenant invested in something necessary to their operation that is expensive to install and nearly impossible to relocate. That makes them stuck on their existing location. Examples of this include internal stairs between floors, large scale kitchen and cafeterias, clean rooms and labs. The dilemma for the landlord is that while these improvements are valuable and treasured by some tenants, they are superfluous to most and possibly a new deal inhibitor rather than accelerant for many potential replacement tenants. The stickiness for the original tenant could be a repellant for most replacement tenants.

Valuation considerations

The first area that is immediately accretive to value is the impact of the amortization of leaseholds improvements in the rental rate achieved and the resulting increase in net operating income. Capping face rents incorporating amortized tenant allowances versus capping net effective rents results in a higher property value. The property valuation is higher as a result of dealing with rents incorporating amortized leasehold improvements.

Another area where leasehold improvements are explicitly accretive to value is in the delta between the target IRR for the office building investment versus the discount rate being applied to the amortization of the leasehold improvement allowance incorporated in the net rental rate. For example, if the IRR is 8.0%, then any leasehold improvement allowance discounted at a rate higher than 8% is accretive to the investment and adds to the IRR achieved.

This math works as long as the landlord is a cash investor. Likely for all the levered buyers and value add investors, their levered IRRs and equity returns exceed the discount rate for amortizing leasehold improvements, and as such the tenant improvement allowance is not accretive to IRR.

Another area of unaccounted for value is as a result of the difference between the period over which the leasehold improvements are amortized and their economic life. For example, if the leasehold improvements are amortized over the term of the lease, any leases less than the 10-15 year economic life of the leaseholds still have some value at the end of the term of the lease. The value of the fully amortized and paid for leaseholds and their remaining economic life depend in part as to how generic these leaseholds are, i.e. how likely it is that they will be acceptable to the replacement tenant. In essence, the landlord gets the benefit of fully paid for leasehold improvements that attract replacement tenants and gains leasing traction or a better net effective rent as a result.

I have not previously explicitly considered the age of the existing leasehold improvements as a factor influencing some underwriting assumptions, including;

- that as the existing leaseholds age, perhaps more could be allocated to retention costs to reflect increased refurbishment costs;

- considering time in occupancy within a suite, as eventually the leaseholds have to be replaced, and few tenants enjoy or put up with replacement going on around them after 15-20 years in occupancy. This could be reflected in a decreasing probability of renewal as the time in occupancy exceeds 10 plus years;

- that a particular building within a particular submarket may have a competitive advantage relative to vacancy within its peer set as a result of more generic or more recent leasehold improvements that is reflected in a lower cost to secure replacement tenants and a reduced lag time while vacant;

- recognizing that the demolition costs (of $5.00 psf net plus) will not be allocated to the leasehold improvement allowance being provided to new tenants, and represents a cost to the landlord; and,

- distinguishing between vacant lag periods for suites requiring leasehold refurbishments versus suites requiring demolition and new construction.

In summary

There is some magic in leasehold improvement management I believe I have started to uncover, and suspect there are practitioners who got this optimized a long time ago. It may have to do with ensuring there are tenant improvements that have more universal appeal, particularly for the more expensive items that tenants would prefer to have but may struggle to get included in the budget.

My impression is that there is “additional value” not captured in valuations that is related to tenant leasehold improvement costs that make office buildings more valuable than it may appear from a replacement cost perspective, particularly at the start of long-term leases with expensive leasehold improvements.

Please do reach out with comments to help me along with this investigation