The good news for Ottawa is that it is the location of the head office for the Government of Canada. The associated constancy and the credit covenant of the federal government adds stability to the office market here. The federal government employs over 140,000 people in the Greater Ottawa area in a labour force of about 700,000. As most of its employees work in office buildings, the federal government is the largest player by far in the office leasing market, whether as an organization leasing office space (roughly 20.9 million square feet) or owning office space (roughly 21.9 million square feet.

The good news for Ottawa is that it is the location of the head office for the Government of Canada. The associated constancy and the credit covenant of the federal government adds stability to the office market here. The federal government employs over 140,000 people in the Greater Ottawa area in a labour force of about 700,000. As most of its employees work in office buildings, the federal government is the largest player by far in the office leasing market, whether as an organization leasing office space (roughly 20.9 million square feet) or owning office space (roughly 21.9 million square feet.

What most outsiders struggle with is scale: the federal government is a very big organization for which the real estate requirements are “off the scale” relative to most other employers in Canada. The other struggle for outsiders is the peculiarities of how they deal with their real estate requirements.

What most outsiders struggle with is scale – just how big their operation is here. The federal government is a very large organization for which the real estate requirements are “off the scale” relative to most other employers in Canada. The other struggle for outsiders is the peculiarities of how they contract for and their expectations of real estate service providers.

A warning for dealing in Ottawa is that the federal government has its own protocol to lease office space. Given their scale, they have made efforts to standardise the processes by which they source office space, they contract for office space, and they manage space they have leased. An additional warning for Ottawa is that the federal government methodology and terms are different that the more usual net lease terms used with private sector tenants, and for which the Building Owners and Managers Association (BOMA) measurement standards apply. It is easy to get tripped up modelling this cash flow and underwriting their occupancy.

Hence the question: how did you make out in your lease to the government?

The following discussion examines some of the peculiarities of how the federal government leases space, and how that contrasts with leasing to private sector firms. We attempt to quantify:

- the impact of choosing to lease to the federal government;

- a metric that incorporates credit differentials between the federal government and private-sector firms.

This will help to determine what the “credit advantage” the government professes/implies if you do the math. We don’t really expect to get this right, so you can safely quit reading now if you are expecting the definitive text on this issue. Sorry, we provide no miracle cures here.

We are attempting to outline the issues, explore some rationale towards an answer, and rely on all those smart folks to correct our mistakes and enlighten us all. Kind of like the scientific method, e.g. ask a big question, propose a hypothesis, provide evidence, and expect that vigorous debate leads to insights and perhaps an approach for analysis that is at least less wrong. The important part of this method is the debate.

The Big Question and Hypothesis

The federal government has always believed it is entitled to a discount on rent resulting from its creditworthiness. Just how does the PSPC (Public Services and Procurement Canada, formerly and occasionally still PWGSC, the department responsible for leasing office space in Ottawa) methodology for contracting for office space attempt to secure this discount? Is the discount they obtain reasonable on a risk-adjusted basis?

Our hypothesis is the perceived federal government discount leads to an expected value for the loss incurred should the private sector competitors for the same space fail to pay rent, and the owner gets the space back. We believe the credit market provides a protocol to determine this risk-adjusted analysis.

To determine this expected loss, we need to:

- explore the areas in which the federal government receives a discount as a tenant relative to private sector tenants;

- determine the impact on cash flow and value resulting from this discount discount;

- determine a net present value for these discounts;

- determine an implied probability for these expected losses; and

- compare the credit differentials necessary for this expected loss to arise.

In this blog we attempt to catalogue all the differences that could arise between the PSPC lease deal and a more typical private sector lease deal. We will move on to the financial analysis in a subsequent blog.

Federal government lease form norms

The federal government leases office space in rentable square meters on a semi-gross basis. It establishes a standard for tenant improvements – carpet, paint and ceiling with a runway for IT services – and does not ask for or expect a tenant improvement allowance. Additional specifications include:

- It sets a base rent that does not escalate during the term of the lease;

- it sets a base year for taxes and utilities and allows actual increases to be recovered;

- it sets a base year for all operating costs and allows some recoverable operating costs to be increased by inflation annually;

- it allows a management fee of 2% on the recoverable operating costs;

- it does not permit capital investments to be amortized and recovered;

- it requires annual audits of operating costs and taxes based on the anniversary date of the commencement of the lease;

- it uses its own area measurement standard that it determines and verifies.

Most landlords experience a decline in bottom line revenue from a government lease. They find that net income declines over the lease term as those non-recoverable elements experience annual cost increases.

Outlining Differences that could cost landlords

- Measurement Standard: The federal government does not use a BOMA standard to determine its usable area or its rentable area. It has a different treatment for how space is measured, and that results in a determination of rentable area that is 3% – 5% less than what would apply to a private-sector firm in the same premises. This slippage in area becomes a slippage of 3%-5% of gross rental revenue.

- Amortization of Capital Investments: The federal government does not allow for capital expenses to be amortized and recovered in the lease. Any existing recoveries will not be paid, and any proposed recoveries for capital expenses incurred during occupancy will not be paid. Any costs associated with upgrades necessary to meet their continually upgraded accommodations standards are not recoverable.

- Unrecoverable Operating Cost increases: The federal government restricts the items that may increase over time in the recovery of operating costs. Any operating costs not deemed recoverable will result in a cost to the owner as these non-recoverable expenses increase over the term of the lease. For those operating costs that are recoverable, it may restrict the annual increases for these recoverable costs to Consumer Price Index (CPI) over the base year amount specified in the tender document. It may permit actual increases in utility costs and municipal realty taxes from the base year specification. The base year specification is also a little tricky, in that the base year for taxes is the first full calendar year of occupancy, and that may differ from the first full year of occupancy.

- Management Fee slippage: The federal government restricts the administration fee applied recoverable operating costs to 2% of those costs. There is slippage from the full management of 15% applied to all operating costs, including perhaps utilities and municipal realty taxes. That may result in administration fees to be recovered do not match or exceed the management costs incurred, and that could reduce net income.

- Additional Audited Statements costs: The federal government demands annual audited operating cost statements. An additional cost is incurred as the statements must reflect a year starting with the commencement date of the PSPC lease, as opposed to a calendar year for all other tenants of the building. Any leases with different start dates in the same building require an audit for each of the different start dates. The audits will likely be for split years, adding to costs to prepare the audit.

- Municipal Realty Tax appeals: The federal government insists that realty taxes be appealed and retains the right to appeal in the event the landlord does not. The landlord will pay for the appeal whether it conducts the appeal, or the government conducts it.

Other Lease Form Considerations

- Area Measurement Value slippage: Not only does the rentable area calculation affect the rental revenue, it affects the value of the property as there is 3% – 5% less revenue from the same usable area. Assuming the basic rent is $20 per square foot, the measurement rental rate slippage is $0.60 per square foot per annum, while the value loss at a cap rate of 6.0% is $10 per square foot. That value loss extends for the term of the government lease and could be net present valued at the landlord’s target IRR for that holding.

- Tenant Improvement Allowance Value slippage: Value is a function of net operating income, and the rental income from private sector tenants usually incorporates some amortization of leasehold improvements. As the federal government does not look for a leasehold improvement allowance or tenant inducement allowance (other than free rent periods) there is a gap in the basic rent between a federal government tenant and a private-sector tenant occupying the same space but enjoying a more generous allowance that increases the basic net rental rate. The market expectation for federal government base building standards for the tenant improvement portion cost is about $15 – $20 per square foot.This includes installing the suspended T-bar ceiling, painting the demising walls and installing the carpet. This figure excludes any additional base building improvements necessary to meet their standards of office accommodations. The tenant improvement or leasehold improvement package being offered to private sector tenants is market-based and subject to competitive strains. Typical new tenant fit-up will require investments of $50 – $80 plus per square to provide office accommodations, some or all of which may be paid for by the landlord and then amortized in the rental rate. Also, there is a differential in the commission fees paid for a government lease versus a private-sector lease.The market norm here is there is no tenant representation for the federal government. A government lease provides commission savings for the owner.Overall then, the asking rent for a private-sector transaction versus a lease to the federal government has an additional $40 – $60 per square foot of amortized lease costs included. Depending on the term of the lease over which the tenant inducement is recovered and the capitalization rate applicable to the property, there is a notional loss or abeyance in the capitalization of that asking rent differential.

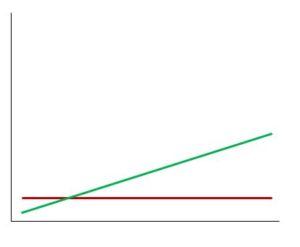

- Flat Rental Rate throughout the term: This issue becomes more problematic as the length of the term increases. Most investors expect that basic rent increases over the term and hope to achieve rental rate increases roughly matching inflation over the term of the lease. This is especially important for pension fund investors, as they acquire real estate to meet liability obligations for their pension plan, and as those liabilities increase by inflation annually, they need investments that do the same.The market norm in North America is a rental rate increase at least every 5 years. A federal government lease disadvantages its landlord by failing to provide that rental rate increase, and that can be quantified at the net present value through the internal rate of return expected of this property.

- Deal Timing costs: The federal government is usually looking to secure space with about 24-30 months before the occupancy date. In addition to these long lead times, they typically require that the space be made available to them 12-odd months prior to occupancy so that they can complete all their fit-up work. There is a potential cost to the owner of committing to not receiving any rent until the occupancy date, and that out-of-term free rent period associated with completing tenant improvements may as well be longer than that required or demanded by private-sector tenants.

The Fussiness Factor

In addition to these lease clauses that affect the cash flow and value of the government lease, there are additional terms that are different to those used by private-sector firms. The government insists on an “Integrity Regime” clause and a “Security” clause. The Integrity clause permits the federal government to terminate a lease if the landlord, its affiliates or its subcontractors fail to remain free and clear of any acts or convictions specified, said acts usually constituting fraud, bribery, income tax disputes and bribing foreign officials amongst others.

As well, the landlord’s firm must hold a valid Designated Organization Screening as issued by the Canadian Industrial Security Directorate, as well as its personnel requiring access to protected information, assets or any part of the leased premises must hold a valid security clearance issued by the same directorate.

Reconciliation of operating cost actuals versus estimates is usually completed within 4 months of calendar year end for private-sector tenants. The federal government is behind schedule in this process, as much as 1-2 years. Leasing to the federal government greatly extends that reconciliation period.

Lastly, the federal government pays rent in arrears and not in advance. That can be tricky at the start of the lease managing cash flow.

Anything Else in this list?

It will help in the discussion if we start with a complete list. Please do get back to us to point out what we missed, what we got wrong, and what other differences can impact net operating income and value so that the model that gets developed to determine this risk-adjusted parameter is more robust.

Are there any other differences between a PSPC lease deal and one to the private sector that can affect cash flow or value that you look to quantify?