It is hard

to tell if the changes in the Ottawa industrial market are because of Amazon,

exacerbated by Amazon, or maybe just correlated with Amazon’s arrival.

What does

Amazon occupy here?

Amazon

leased a 1,000,000 square foot facility built for them a little east of the

city in 2020. They leased a 2,800,000 square foot facility built for them in a pioneering south-end

location in 2022. They leased an existing 105,000 square foot facility in 2021.

They may have leased a 300,000 square foot facility being developed by the same

developer (1 million and 2.8 million sf projects) with delivery in late 2023.

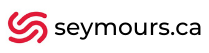

This means

Amazon is operating in 3.9 million square feet and potentially adding another

300,000 square feet. This quantum of leasing is a staggering amount in an industrial

market of either 35.6 million square feet (CBRE), 46.2 million square feet

(Colliers), or 26.7 million square feet (Cushman & Wakefield). This

represents a dramatic (almost overnight) increase in supply, and ranges between

9% and 15%, depending on which brokerage you believe has the best

representation of Ottawa industrial market dynamics.

One Amazon

effect is suddenly there is demand for new industrial facilities here. That increased

user demand is attracting investor and developer interest in the industrial

market here.

How did Amazon

change the logistics site selection protocol to favour Ottawa?

Traditionally,

Ottawa is a market that gets distributed to, not from. For Amazon, Ottawa is now

a market that distributes to other markets. The Greater Toronto Area is about 400

km away and less than 4 hours driving, the Greater Montreal market is about 200

km away and 2 hours driving. Both these industrial markets have been, until

Amazon, the place from which logistics firms service the Ottawa market.

source: CBRE Canadian Industrial figures Q1 2022.

Amazon believes their Ottawa operations can service 10 million people within a 400 km radius. That gets some of the GTA, all of Montreal and parts of northern New York State. Now that Amazon has landed here, other firms are looking to locate here. Maybe other firms assume the Amazon magic in site selection just needs to be copied, given Amazon’s data collection and analysis rigor.

Another Amazon effect is that this market, Ottawa, is now a potential distribution hub.

Why is Amazon in Ottawa if Walmart is in Cornwall?

The issue here is demographics. Cornwall is a better location for logistics, as it has better highway access to the GTA along Highway 401. Walmart, Canadian Tire and Giant Tiger all have a presence in and near Cornwall for that reason.

The Cornwall census agglomeration area had a population of 61,000 people in 2021. It had population growth of 2.9% since the previous census. The Ottawa-Gatineau census metropolitan area had a population of 1,488,000 in 2021. It had population growth of 8.5% since the previous census. We believe logistics firms may have exhausted the available labour force in Cornwall, and Ottawa has more potential for employees.

Another Amazon effect is an immediate increase in demand for certain workers.

Did Amazon kick-start industrial development here?

It has certainly affected industrial land prices in Ottawa. A specific sale of an industrial parcel helps illustrate what has happened.

A landscaping company bought 22 acres of industrial land in a long-dormant south-end business park in January 2020 for $6.5 million or $300,000 per acre. An 86-acre parcel in the same business park was purchased for development for an Amazon facility for $34.6 million or $400,000 per acre in November 2021. The landscaping company resells its 22 acres for $25 million or $1,510,000 per acre in March 2022. That is a rate of return of 5.3% per month on its land investment.

We looked at building permits issued for new industrial buildings since 2012. That totaled about 6.3 million square feet. Once you take out the Amazon buildings, there were 55 building permits for new industrial projects for a total of 2.5 million square feet. That is about 250,000 square feet per annum, or (much) less than 1% of the existing inventory. The average new build was 44,000 square feet, and the mean number of new builds annually was 6.

Amazon has certainly highlighted just how old and functionally obsolete the existing inventory of industrial buildings is for the operations needs of Fortune 500 companies There is certainly a stampede to buy industrial land and develop property in Ottawa.

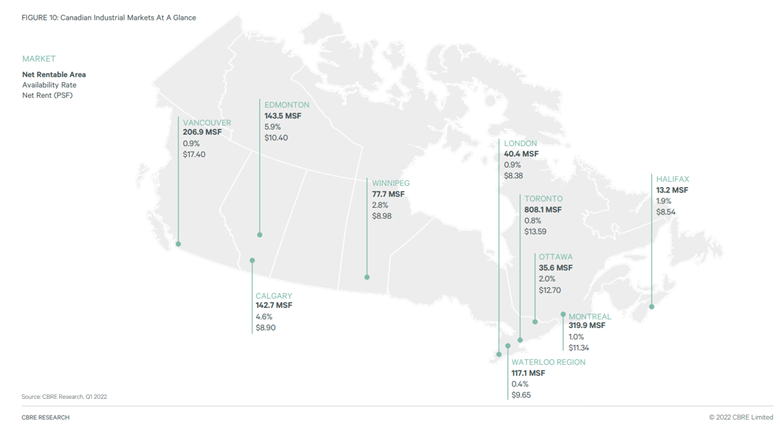

It seems that the industrial market in Canada has enjoyed little availability for more than a decade, however the new catalyst for construction of industrial buildings corresponds with a tremendous expansion by Amazon across the continent.

source:

CBRE Canadian Industrial figures Q1 2022.

Amazons’

effect has highlighted just how little industrial space is available. It also

highlighted the existing inventory was functionally obsolete in meeting its

current operating protocols and efficiencies.

Another

Amazon effect is to kick-start interest in industrial development here, despite

this being a small market close to two much bigger markets.

Just how

much did Amazon build?

Globe

Street reports that at the end of 2019 the Amazon

distribution network leased 154.0 million square feet and owned 4.5 million

square feet in North America. By the end of 2021, they leased 370.4 million

square feet and owned 16.6 million square feet, and that is growth of 228.7

million square feet. This scale of expansion has repercussions on construction

materials, pricing, and availability. It also taxes the capacity of the

development community to meet additional demand.

Maybe all

that expansion by Amazon had the investment community take notice of the

opportunities available in what had previously been a relatively unsexy asset

class. The easy money investors focused on the opportunity to dramatically

increase rents in existing facilities, as there is almost no supply for

relocation. The mainstream developers for logistics firms struggled to keep up

with the increase in demand resulting from the acceleration of e-commerce in

the pandemic. That struggle to keep up with demand shows up in the data from Prologis.

source: Prologis

Industrial Business Indicator May 11, 2022.

Another

Amazon effect was to focus the attention of the real estate investment

community on the strong fundamentals for easy money increases in rental rates

in the existing stock of industrial properties. That gap between economic rent

for new construction and existing market rent has been narrowed by dramatic

increases to rents in existing product.

Now that

Amazon is slowing the pace of its expansion internationally, we will find out

whether Ottawa activity is correlated to Amazon activity or caused by Amazon

activity.

What are

you finding in your market?